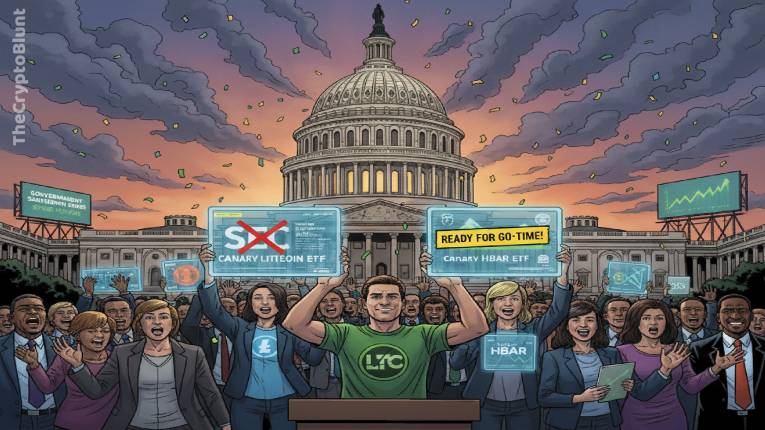

It is posited by Exchange-Traded Fund (ETF) expert Eric Balchunas that the applications submitted by Canary Capital for physical Litecoin and HBAR investment vehicles appear to be formally completed, but their introduction will be deferred by the stoppage of governmental operations.

The financial management firm Canary Capital appears to be on the verge of receiving official sanction for its Litecoin and HBAR exchange-traded instruments (ETF) subsequent to the submission of essential conclusive data, but their inauguration is not anticipated while the United States governing administration remains non-operational.

Modifications were formally submitted by Canary on Tuesday to its physical Litecoin (LTC) and Hedera (HBAR) Exchange-Traded Funds (ETFs), with each instrument being assigned a 0.95% management cost and the designations LTCC and HBR.

It was stated by Eric Balchunas, an Exchange-Traded Fund (ETF) expert with Bloomberg, in a social media communication on Tuesday that these supplementary components “are routinely the concluding elements that are adjusted [prior to] launch readiness.”

It was further mentioned by him that since the United States government has ceased operations and the Securities and Exchange Commission remains largely non-responsive, the timing of their official endorsement cannot be determined, but the submitted documents “are viewed as quite conclusive” by him.

It was also believed by James Seyffart, a colleague ETF expert at Bloomberg, that the formal revisions are a favorable indicator that an endorsement is imminent, and it was stated by him that it “feels like the Litecoin and HBAR ETFs have reached the conclusive stage of completion here.”

It was forecasted by market observers from the digital asset trading platform Bitfinex in August that the official consent for Exchange-Traded Funds (ETFs) connected to alternative coins might precipitate a renewed upward trend for altcoins, as the financial instrument would provide access to the tokens for investors.

ETF Fees Exceed Bitcoin Spot Funds, Yet Analysts Call Them ‘Normal’

Physical Bitcoin Exchange-Traded Fund (ETF) costs are typically situated in the range of 0.15% to 0.25%, as is documented by Ledger, which is substantially higher than the 0.95% charges levied by Canary, yet it was noted by Balchunas that this rate is not considered anomalous.

“My take on the 95bp fee. It’s pricey vs spot BTC, but pretty normal to see higher fees for areas that are new to being ETF-ed and increasingly niche,” he said.

It was, however, also highlighted by him that should the Litecoin (LTC) and HBAR Exchange-Traded Funds (ETFs) garner satisfactory capital inflows and investor engagement, a strategy of competitive pricing might be pursued by alternative financial providers to undermine Canary and offer more economically priced instruments.

ETF Issuers Push Ahead With 3x Products Despite Government Shutdown

Even though the United States governing body might be non-operational, applications for novel Exchange-Traded Funds (ETFs) are nevertheless being formally submitted by corporations, according to Balchunas and Seyffart, with a particular emphasis being placed on instruments featuring three times leverage.

A financial instrument known as a 3x Exchange-Traded Fund (ETF) is designed to shadow a broad range of holdings, including equity shares, and employs financial borrowing to achieve three times the daily or monthly yield. In the past, high-leverage cryptocurrency ETFs were denied approval or failed to gain consent from the Securities and Exchange Commission (SEC) due to reservations concerning the safeguarding of investors in relation to price fluctuation and intricate nature.

Sixty novel 3x Exchange-Traded Funds (ETFs) were formally proposed by the ETF originating entity Tuttle Capital. An additional collection of ETF applications was also presented by GraniteShares, another ETF provider, which encompassed a variety of financial instruments, among them Bitcoin (BTC) at $121,384 and Ether (ETH) at $4,435. ProShares also became involved in the competition with a succession of official submissions.

It is projected by Balchunas that approximately 250 applications for 3× Exchange-Traded Funds (ETFs) exist, and it was stated by him that issuers simultaneously submit such a large volume because they “generate substantial revenue.”

“A powerful combination within a market economy is formed by the eagerness of highly speculative investors and their lack of sensitivity toward costs,” was additionally stated by him.

It was clarified by Balchunas that such Exchange-Traded Funds (ETFs) establish a 2x borrowing ratio through the application of financial exchange agreements, but they will then “employ derivative contracts to aim for an additional 1x.”

Government Shutdown Puts ETF Approvals on Hold

The digital asset sector was poised for an overwhelming influx of novel cryptocurrency Exchange-Traded Funds (ETFs) during October, as final determinations were scheduled to be rendered by the U.S. Securities and Exchange Commission regarding sixteen such instruments over the course of the month.

Fresh criteria for public inclusion were concurrently revealed in September, which possess the potential to hasten the endorsement of physical cryptocurrency Exchange-Traded Funds (ETFs), since it will no longer be necessitated for each separate submission to be examined in isolation, thereby compressing the duration required for official consent.

The governmental suspension of operations, which was initiated on October 1, has resulted in a state of unresolved uncertainty, with target dates being missed and no measures being enacted. It was communicated by the SEC on the same day as the closure that it would persist in functioning but with severely reduced personnel.